Why you should send regular investor updates

If you’re reading this, chances are you have recently closed a funding round or you’re looking to raise capital sometime during the coming months. In either case, you should start sending investor updates on a regular basis. Here’s why.

1. Raising follow-on capital becomes easier

If you just closed a funding round, the participating investors will have at least one thing in common: they trust in your abilities to make great things happen. Otherwise they wouldn’t have invested in your company. You should make it a goal of yours to retain this high level of trust and interest among your shareholders going forward.

This is particularly true if you know you will be raising capital again in the future. A great thing about shareholders is that they will have an ongoing interest in providing additional funding to your company if it is needed. Sometimes follow-on investments are necessary just to earn a return on the initial investment. Other times things are looking so great for the company that most shareholders will want to keep (or even increase) their pro-rata share by partaking in future funding rounds. Whichever is the case, you can reduce your need to find new investors by keeping your current investors interested enough.

So what can you do to keep their interest level high? A regular investor update is an easy way to achieve this. By sharing your wins (and losses) on a regular basis, you create the engagement that is needed. Remember that even though the team, management and board members will know what’s happening on a day-to-day basis, most shareholders will have no clue unless you provide them with regular investor updates.

If shareholders don’t know about your traction, interest levels are bound to decline over time. Keep in mind that no information at all may be taken as a sign that things aren’t looking too great for your company. This will make you more likely to run into big problems during your next fundraising: If current shareholders aren’t interested enough to re-invest, that will be a huge red flag to any new investor looking on from the outside.

On the contrary, regular investor updates will ensure that you stay top of mind among your shareholders which increases the likelihood that they speak favourably about you to other investors. Oftentimes, getting referrals like this is the best way of meeting new investors who become warm leads for your next funding round. So make sure to keep your owners informed and interested!

2. Activating your investors becomes easier

A major reason for raising capital from seasoned investors is the wealth of experience and connections they can bring to the table. The keyword here is can, as you’re unlikely to reap any of those benefits if you don’t make sure to activate your investors on a regular basis.

The investor newsletter is a great tool for achieving this. For instance, you can include a section called “Asks” where you activate investors by asking them to share from their experience or introduce you to someone in their network. A few examples here include asking for introductions to potential customers, recruitment candidates, or even new strategic investors.

It would also be wise to ask your shareholders for help once you run into more serious problems (which, let’s face it, most startups eventually will). No one will be more helpful than your shareholders, which only makes sense since they own part of the company. Asking for (and receiving) help will be a lot easier if you’ve kept the line of communication open by regularly updating your investors, compared to the case where they feel like you’ve been keeping them in the dark ever since they invested.

3. Nurturing relationships with potential investors becomes easier

Those investors who said “no” three months ago might say “yes” in one or two years from now. However, this requires that you nurture those relationships over time, as you would any other sales lead. Your chances of turning a “no” into a “yes” greatly increase by providing regular updates to potential investors.

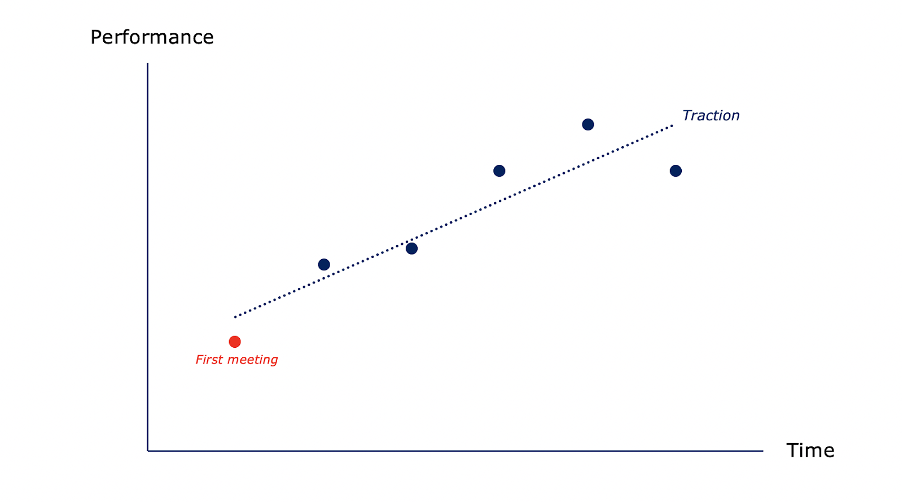

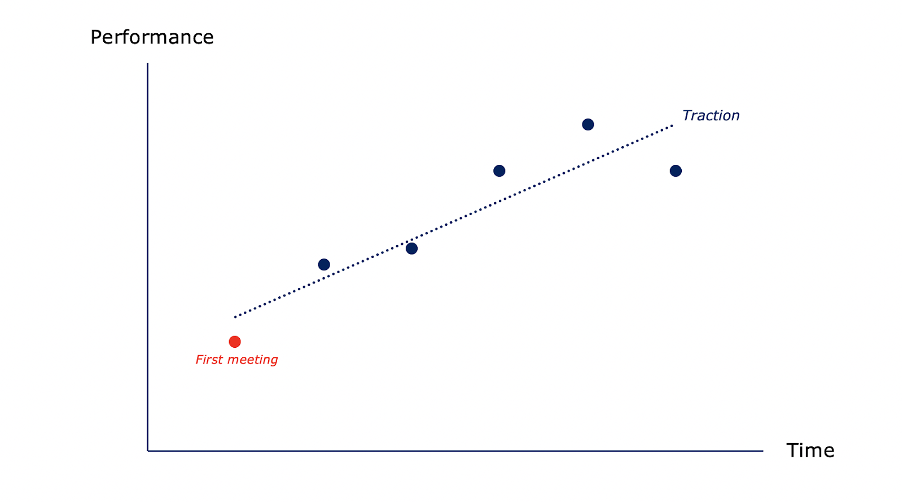

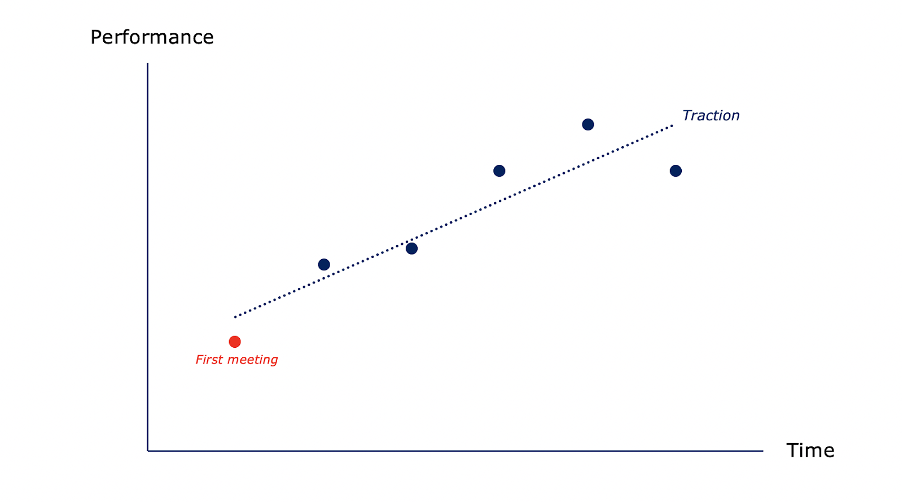

First of all, sharing regular investor updates helps you “draw lines rather than dots”, as venture capitalist Mark Suster puts it. The first time you meet with an investor, you’re simply a dot – a single data point without much context. As Mark argues, the investor knows too little about you and your company at this point to make an investment: “How can you prove tenacity, resiliency or ability to pivot in a single data point?”. Well, you can’t.

The regular investor update is your chance to showcase to potential investors how your company progresses over time, providing the investors with valuable data points and more context with every single update. As you keep adding data points, the investor will eventually be able to see a clear trend of your traction.

As you keep creating and showcasing traction, investors are likely to become more interested in your company. However, traction in itself isn’t always enough, as many investors in private companies often reserve their capital for founders who they already know and trust. The great thing about the regular update is that it has the inherent quality of showing potential investors that you’re open, honest and transparent in your communication, which is a key ingredient in building trust and strong relationships. So even though you might not know the potential investor very well today, you can use the regular update as a tool to nurture this relationship into a more meaningful one over time.

The alternative and perhaps more common approach among startups today is reaching out to potential investors for the first time once the funding round officially launches. Founders who are doing this are essentially trying to build meaningful relationships with entirely new investors in a matter of just weeks or months. This approach to fundraising is, quite frankly, very unlikely to succeed and the result is that startups often end up with either no money at all or the wrong money from the wrong investors, on the wrong terms.

Rather, a more continuous approach to fundraising would be to supplement the ever-important investor meetings with a brief but regular investor update. Done right, the regular update will enable you to spend much less time and effort raising capital once the next fundraising kicks off, since your relationships with potential investors have already been nurtured over a long period of time.

4. Your investors deserve regular investor updates

The last and perhaps most obvious reason for keeping your shareholders updated on a regular basis is the fact that they own part of the company. These investors have just supported you with their hard-earned capital, so it’s only fair that you let them know how the company is putting that capital to use.

Conclusion

Summing up, a short but regular newsletter is a low-hanging fruit that will provide a multitude of benefits to you and your company. Once you’ve created a simple template, it shouldn’t take more than 15 minutes to update your shareholders and potential investors. Trust us, doing this on a regular basis (for instance monthly or bi-monthly) will save you so much time and effort when you launch your next funding round.

In our next blog post we’ll provide some best-practice guidelines (and a great looking template!) on what to include in your investor updates to help you get started.