The case for investor portals

How investor portals level the playing field between investing in public and private companies.

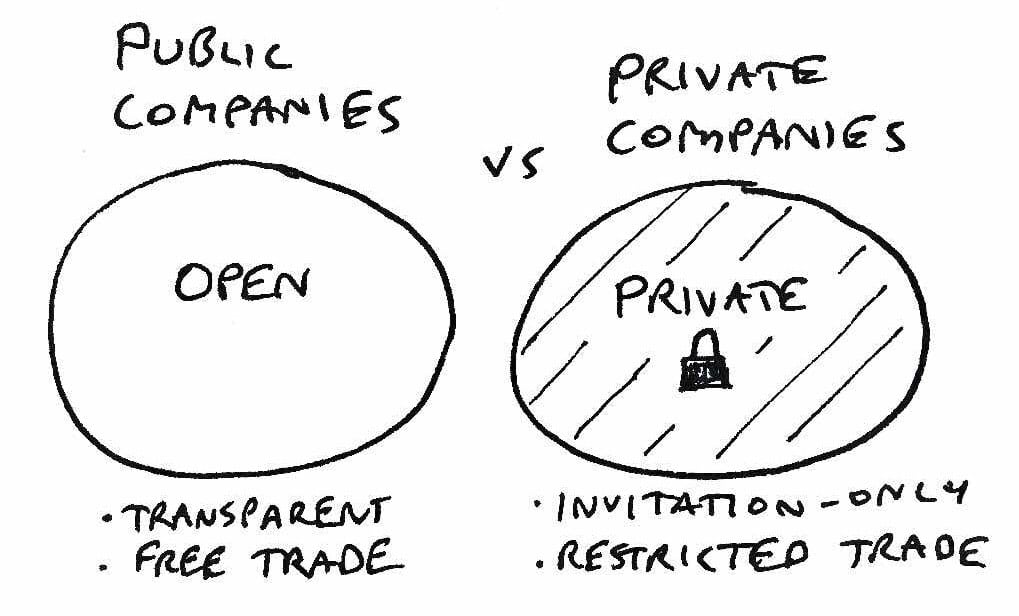

While publicly traded companies are information transparent and open for investment, private companies practice tight information and investor control. Sometimes too tight. Hence, they often lose the battle for capital as investors prefer transparent asset classes with more liquidity.

In private companies everything investment related is private and by-invitation-only. This includes admission to relevant information, transaction process and the company cap table. So, what are the key implications for investors?

Implications for investors

1. Lack of information and transparency

Private companies have less formal reporting requirements and are at times unsure of what information to share with investors. Combine this with limited management bandwidth and the result is too often rare and reactive information sharing with investors.

2. Long-term lock-in

This is due to little share liquidity as well as trade restrictions set out in bylaws and shareholder agreements. In companies that allow transactions it is often difficult to find a buyer, and even more so at a fair price. Reducing trade restrictions internally could have significant positive effects on share liquidity (see blog post on the value of share liquidity in private companies).

3. High transaction costs

The investment process in private companies is extensive compared to buying shares in public companies. Many parties are involved in the process (e.g. buyer, seller, the board and shareholders) and with multiple legal documents (e.g share purchase agreement and shareholder agreement). This is not an issue for investors investing large tickets, but for smaller investments the transaction process in itself could be perceived as too comprehensive and a deterrent to invest.

How investor portals level the playing field

On this background new vendors of investor portals are quickly gaining traction with startups, growth companies as well as mature private companies with many investors. Vendor examples are London-based Capdesk, Carta from Palo Alto, and OwnersRoom* out of Oslo. They facilitate investor relations, governance and deals.

Private companies resemble private clubs in that access is invite-only or granted after referrals from other members. Investor portals handle member management and referrals, so that only those granted access can view information and follow the company.

Email updates are pushed directly from the portals. Investors access and view historic updates as well as document rooms for investment due diligence. Other ownership related processes are also made more efficient and transparent, such as general meetings, voting, signing, board resolutions and cap table management.

Investor portals also make deals less cumbersome and more effective for all parties involved, reducing transaction costs and improving liquidity.

Conclusion

Private companies might never be as transparant towards investors as public companies, but with the technology available today this has more to do with old habits than mindful decisions.

By adopting investor portals private companies can obtain the best of both worlds, – efficient access to capital while still maintaining control over information and ownership!

—

*) The author is board member and investor in OwnersRoom