Raising capital for private companies is not about the perfect pitch or investor roadshows, but about people and relationships.

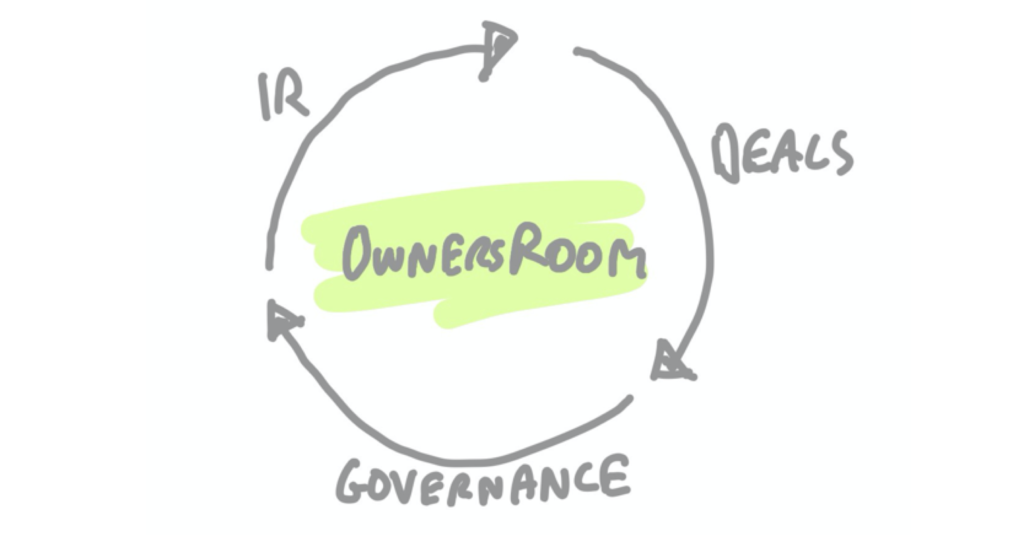

We built OwnersRoom to reduce the barriers for raising capital by facilitating increased engagement and trust-building between investors and companies.

OwnersRoom is an investor platform with three parts that all work together for building such relationships: (1) Investor Relations, (2) Deals and (3) Governance.

Part 1: Investor relations

The objective of Investor Relations is to disclose information and engage with investors in order to increase available capital. The challenge is often how to find the right investors and how to engage with them. For many companies the answer is not that “one size fits all”. Companies need to segment stakeholders and approach each group differently depending on what role they have and how close they are to the company. Examples of different groups are existing shareholders, potential new investors, board members and employees.

OwnersRoom facilitate segmented investor relations based on groups, and use data analytics measuring investor engagement.

Part 2: Deals

The objective of Deals is to raise capital without too much friction. The problem is how to convert investors from investment desire over to actual commitment, — all within a short subscription period. Today this involves a lot of unnecessary hassle for both companies and investors. Investors will print subscription forms, fill them in, sign, scann and return them. Companies will then need to process each such subscription form manually.

OwnersRoom facilitate digital subscription and allocation of securities, — both for primaries and secondaries*. Hence, the Deals solution can be used for providing investors with liquidity as well as for financing the company.

Part 3: Governance

The objective of Governance is to increase transparency and build trust, creating a situation where investors are motivated to hold and increase their investment. The problem is often that ownership and governance information is out of date, not in a shareable format and in systems that make them difficult to manage.

OwnersRoom facilitate updating and sharing ownership information, deal documentation, digital signing, and formal notices throughout the ownership period.

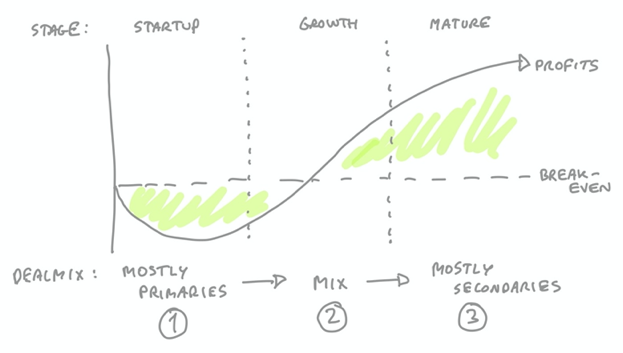

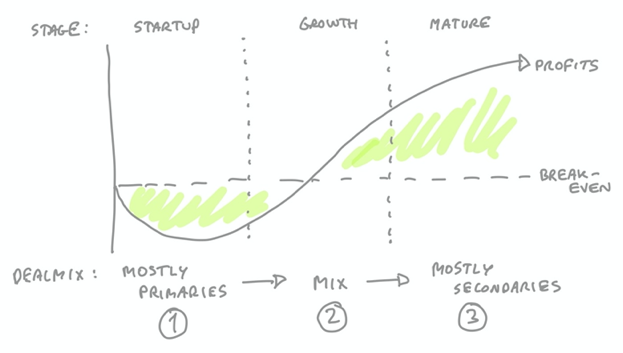

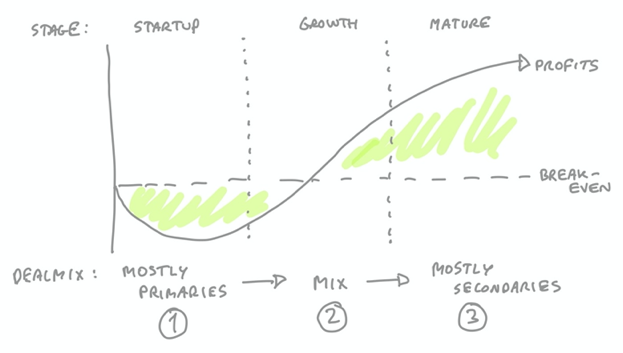

The dealmix change with company stage

The dealmix change over the lifespan of a company from mostly primaries to mostly secondaries*.

For early-stage startups most deals are primary issues to finance the company. This changes as the financing need is reduced, and as some initial investors and (former) employee shareholders want to sell their shares. Hence, many growth companies facilitate liquidity together with later-stage financing.

For mature profitable companies the deals are mostly secondaries, except when financing is needed for new growth opportunities. The ultimate secondary is a merger or sale of the company (M&A).

It’s never to early to start

As the saying goes – aim big but start small. Set up your OwnersRoom today to engage investors, build trust and increase available capital. It’s never too early to start.

Remember, fundraising never sleeps.

www.ownersroom.com

*) Primaries are the issue of new securities (e.g stock or options). Secondaries are deals involving existing securities (e.g trade between investors).

Thanks to Anne Worsøe.