OwnersRoom is an investor and deals platform for deals managed by companies themselves.

These deals could be equity capital raises, secondary transactions, convertible loans, and the issue of derivatives like options for employee ownership.

When there is a deal the company publishes it to their investors for digital subscription and signing – and keep track of the progress using deal analytics. This way you no longer have to deal with the hassle of physical subscription forms.

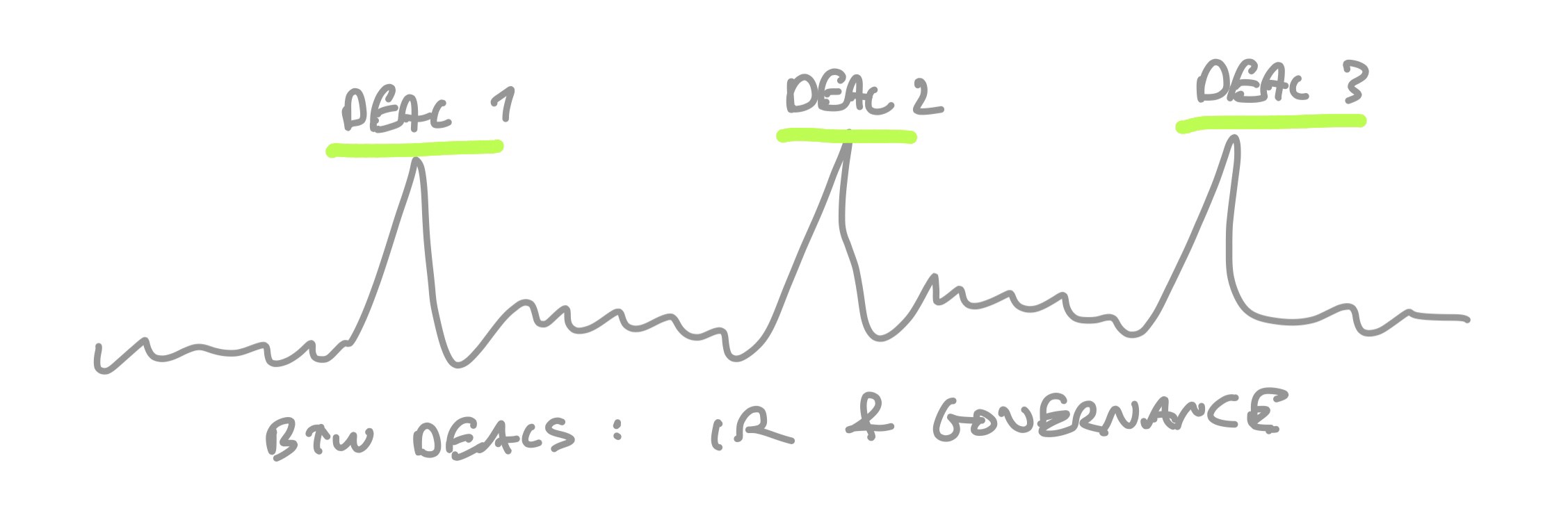

Most customers use OwnersRoom on an ongoing basis. Not only when there is a deal. The drawing below illustrates how the investor activity typically spikes when there is a deal, and drops to a lower level in-between deals.

Keeping the investors engaged and informed in-between deals is worth the extra effort and will facilitate motivation for participating in the next deal. Always be deal ready!

OwnersRoom work with financial advisors

For external deals with investors that are not well known to the company – and when professional assistance and advice is needed – companies use financial advisors and/or regulated private markets.

OwnerRoom is a software company and offers its platform on a subscription basis («SaaS»). The combination of OwnersRoom for the self-service deals – and financial advisors and/or the regulated private markets for the complex deals – enable lower cost of capital across the life-cycle of the company.

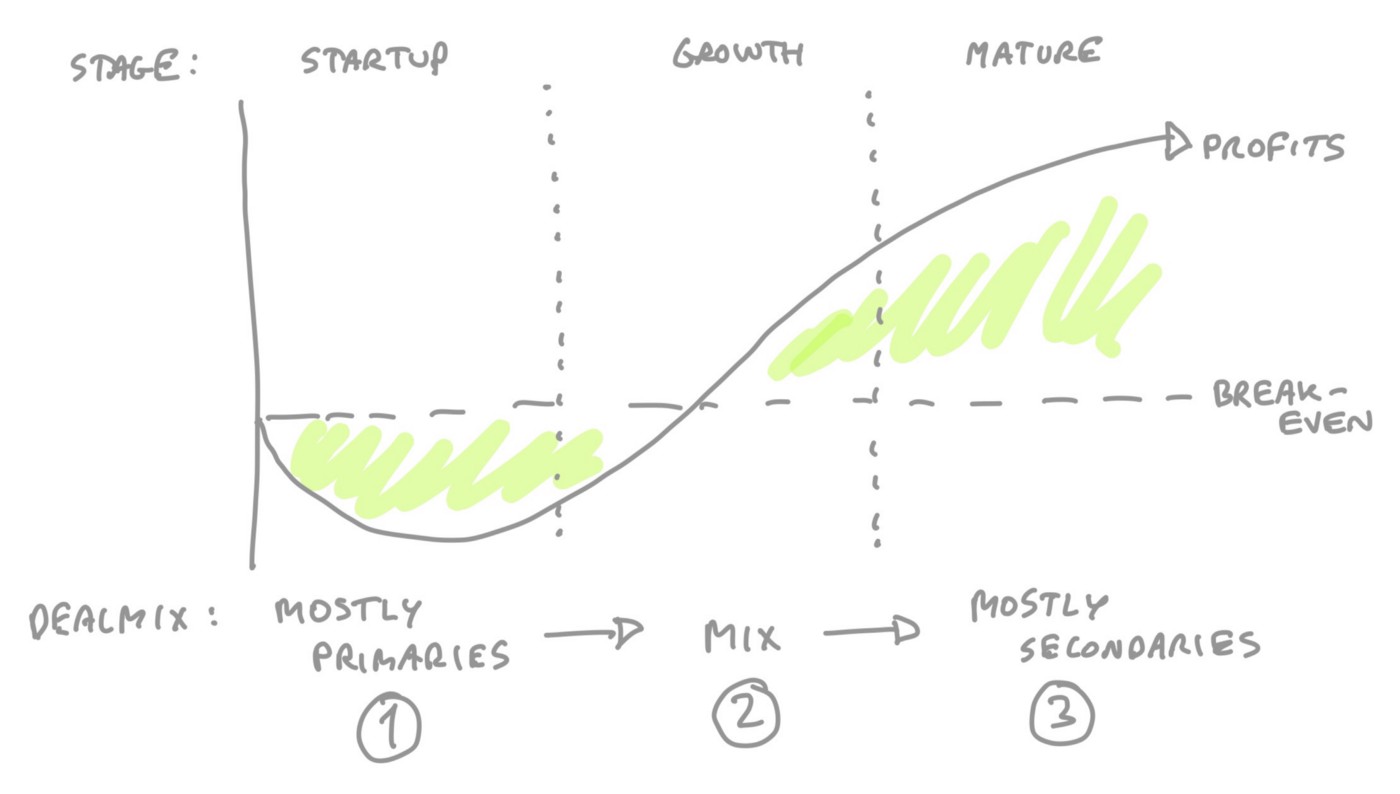

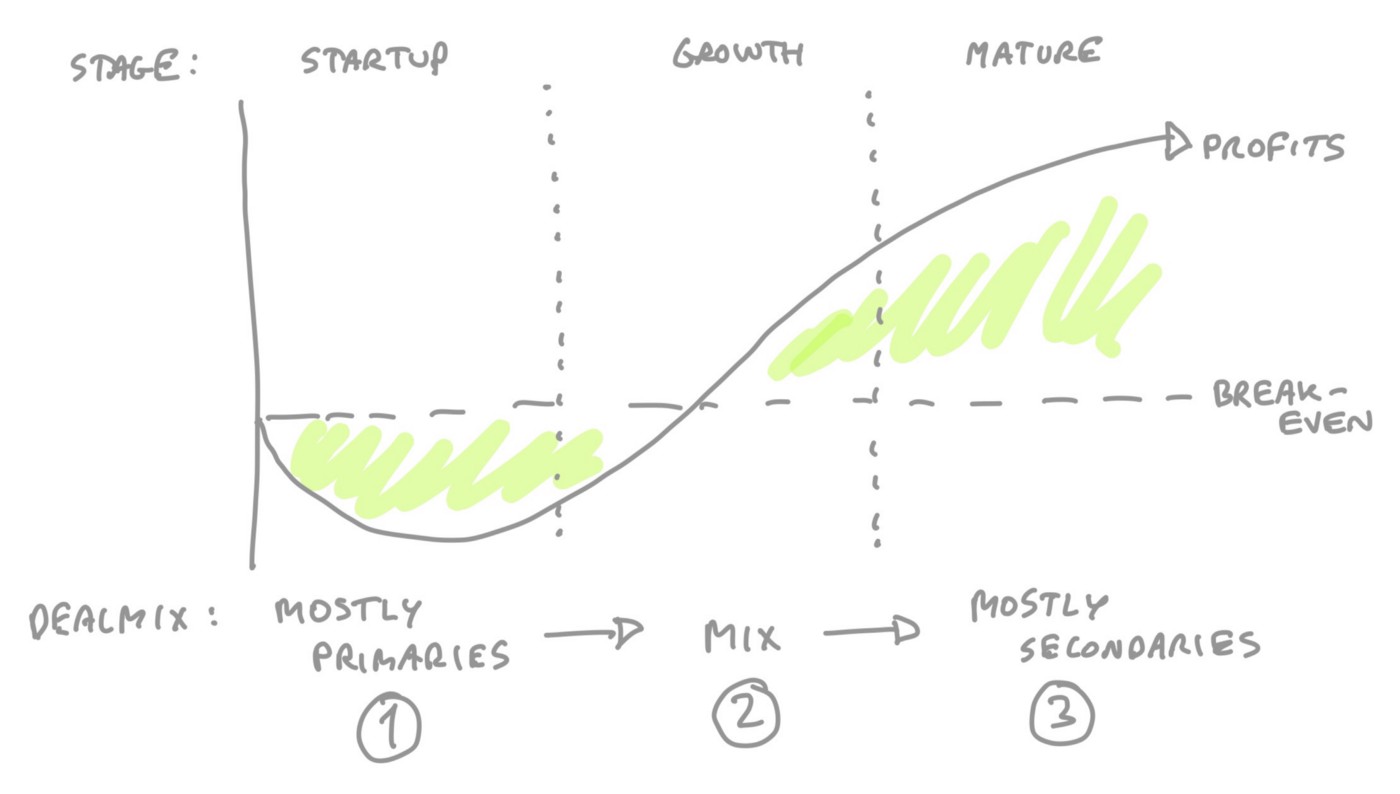

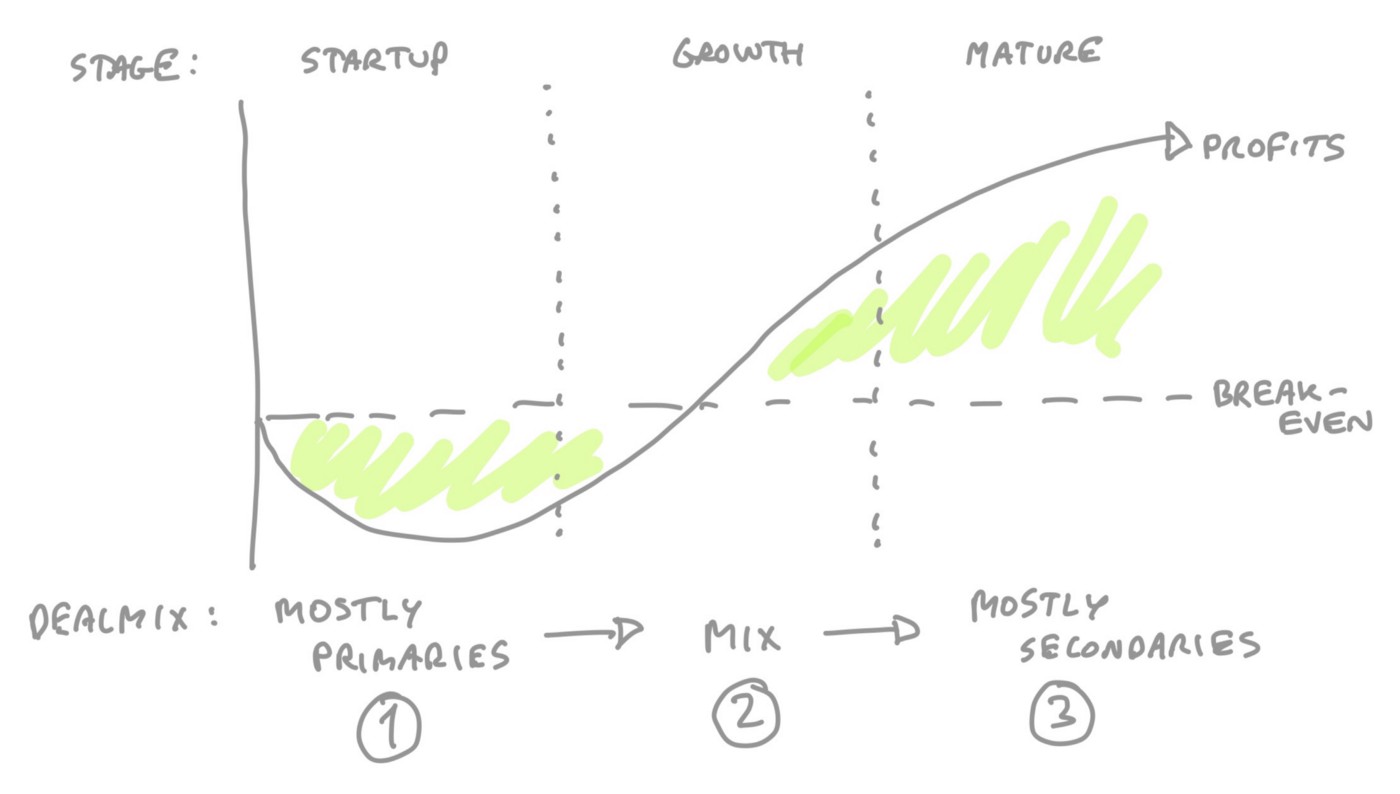

The deals changes with stages of the company

The deals evolve over the lifespan of a company from mostly primaries (the issue of new equity) to mostly secondaries (transactions with existing securities). This is exemplified in the graph below:

For early-stage startups the main objective is to finance the company. This changes as the financing need is reduced, and when some initial investors and early employee shareholders want to sell their shares. Hence, many growth companies facilitate liquidity together with later-stage financing.

For profitable companies, the deals are mostly secondaries except when financing is needed for new growth opportunities. The ultimate deal is the sale or merger of the company (M&A).

Get started now

If your company has investors and plan to raise capital, try out OwnersRoom today for managing your investor base and deals.