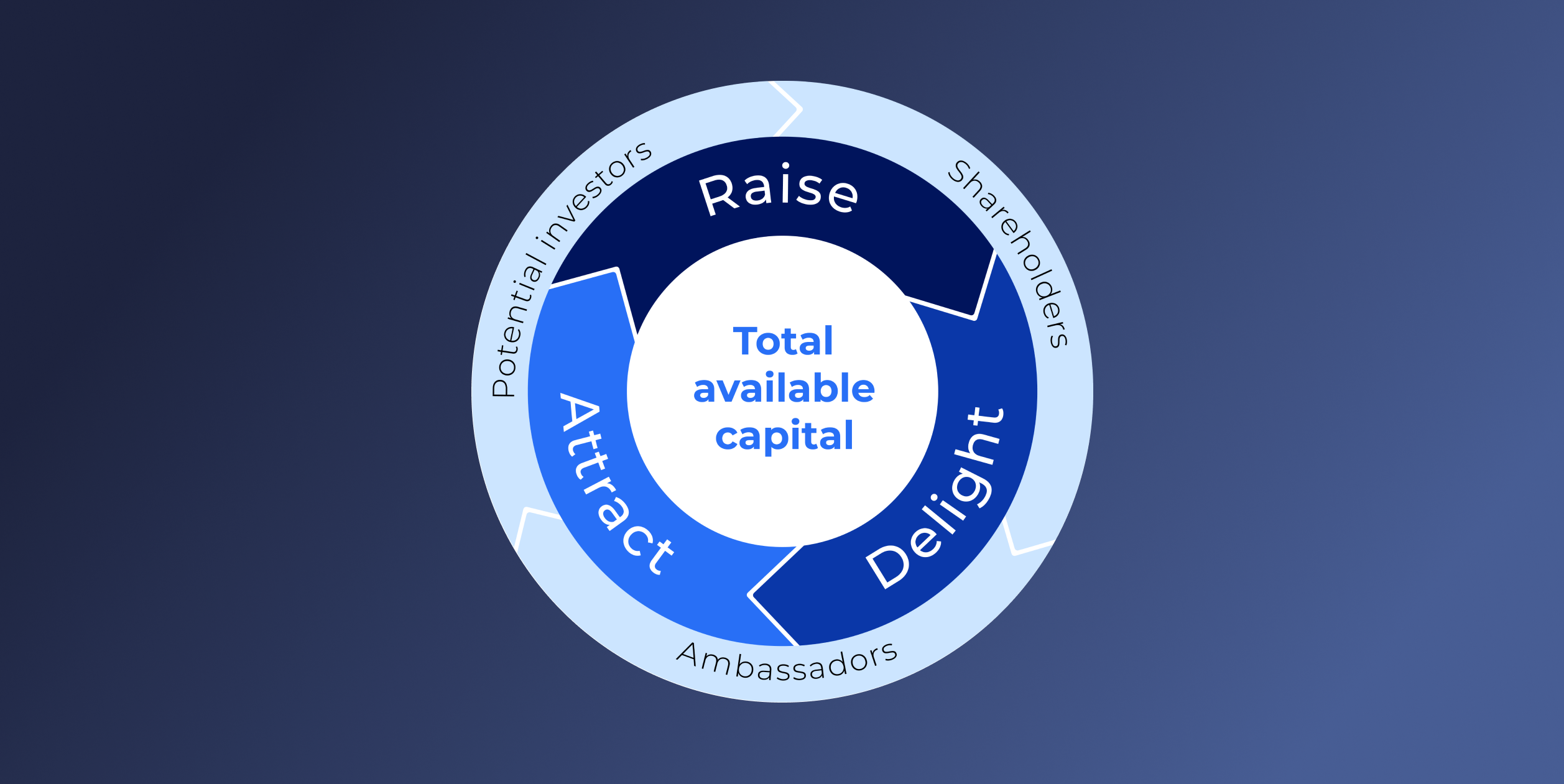

Introducing the funding flywheel

After working with more than 200 startups and growth companies we have learned that funding is a messy process where you have a lot of different tasks and responsibilities. It is difficult to know when to focus on which aspects of fundraising so you often end up focusing on everything, which in reality is no focus at all. But one thing is certain, you have a clear goal; get cash to grow your business. The goal of funding is to obtain as much of your total available capital as possible.

Total Available Capital = untapped capital in your investor network

Usually, funding is seen as a straight line, find investors, run your fundraising and get the pro rata investment moving forward, and if you are lucky, you also get strategic advice and support along the way. Now, let’s look at it through the flywheel instead. You attract potential investors, turn them into shareholders through fundraising, and delight them by showing traction and making sure they are happy about their investment. The key here lies in delighted investors that are happy about their investment will have a higher probability of becoming ambassadors and recommending you to other investors. Your fundraising does not end with the investors, it starts the next one.

That investors refer other investors to cases and often look at them together, is as common as you discussing with your partner about purchasing a new home before actually purchasing it. You can think about it like this, one funding round equals one round trip around the flywheel. And as we all know you probably need to get funded more than once. The funding flywheel will be right along your side to make sure your funding activities go as smoothly as possible so that you can focus on building and scaling your business.

Attract – building your investor network

The primary goal here is to increase your available capital by expanding and strengthening your network of potential investors. So how do you start? It depends on how far along your journey you are and which network you already have in place but always start by asking yourself “Who do I know?”. This is probably the most important question in preparation of your fundraising. You have probably heard about the six degrees of separation theory? If not, it implies that you are six or fewer social interactions from anyone in this world, even Elon Musk, Jeff Bezos, or the king of Norway. So by branching out of your current investors and network you are going to reach a lot of new potential investors.

Once you have cleared out your who-do-I-knows take a look at the investors of companies in the same industry, or use databases such as Pitchbook or CB Insights – both of these have free trials (Shifters investor database is great if you’re looking for Norwegian investors)! Another way to meet investors is to join events, so if you’re a SaaS business, sign up for SaaSiest for example, Slush is another good suggestion.

Remember, it’s always better to be introduced to an investor than to cold reach out, but you can’t avoid this either. We all know trust is a central aspect when it comes to fundraising. But trust is built over time, so start building those relationships early, so that you are ready to reap the benefits when the timing is right.

Raise – handling due diligence and collection application forms

Raise is all about obtaining what you need of that available capital you have built up. Handling this process with as little friction as possible will greatly increase your chances of keeping investors satisfied, and of course, reduce the amount of headache you inflict on yourself. Raise covers everything from due diligence, pitch deck creation, pitching to investors, collecting subscription or application forms, and of course the allocation and payments as well. As there are many aspects here, there are also many opportunities to decrease friction! For a fuller overview, I recommend you to take a look at our Fundraising Playbook.

To get going, you need to decide terms for the funding round; How much are you raising? At which valuation? How? Are you doing a pure funding round, SAFE/SLIP, or convertible loan? Make sure your board and key investors are aligned on the valuation of the company, by involving them in the process. Making some investors pre-commit to the deal will help ensure traction in the fundraising and reduce the risk for you, them, and the other investors.

I know this sounds unfair but you’ll most likely spend a lot of time on creating the pitch deck, and the reality is that VCs only spend on average just above 2 minutes reviewing it. And that is one of the reasons why you should make sure that your potential investors easily can access other relevant documents, maybe even previous investor updates to show that you take care of your investors and easily showcase traction, and of course the cap table with the employee option plan visible so they see you have a good plan for future hires. All of this is a part of the due diligence process, and which documents to share can be tricky to understand, that’s why we created a due diligence checklist for you.

The best tip I can provide here is to communicate clearly and make it easy for investors to understand the next steps. Start by sharing an update where you lay out the important dates to remember and when they can expect information, and follow up along the way. If you are using a system to handle the fundraising itself be sure to utilize data and analytics to know when to follow up which investor.

Delight – make sure investors are happy campers

Once the capital is in place it’s time to make sure your investors feel that giving you their money was the right decision. The best way to do this is of course by creating traction and making your business grow, but other than that you should strive for transparency. Share information and communicate with investors regularly, even if it’s been a really, really, bad month, your investors will appreciate the honesty, and maybe they can help as well.

Transparency is not only about information you push to your investors, but it’s also the information that lies accessible to them. Make sure you have a dedicated place where you store all relevant documents, this could be google drive, dropbox, or on a platform like OwnersRoom. Just make sure you structure it so that as your company grows, it’s easy to gradually build the data room. If you are an early stage startup you’ll probably do fine handling your cap table in a spreadsheet, I’ve even seen people use word or docs.

If you do enough at this stage your next funding will be much easier, since your current shareholders are essential for your next capital raise. Both in terms of helping you expand your network but also with their follow-on investment. This is the key of the Funding Flywheel, turning shareholders into ambassadors, not by force, but by doing what you can to make sure they are happy campers. It’s no secret that investors talk to investors.

How to get started with the Funding Flywheel

If we take a look at the funding flywheel as a whole you probably have some idea of which aspects you already are doing good at, so figure out where you are lagging behind and focus here, this is the section that has the highest impact for you. If you have good traction and a super warm network of investors, but the total capital they have is €1m and you are raising €5m, it’s time to expand that network and focus your time on Attract. Either by hot introductions from your ambassadors or by reaching out to strangers.

The goal is not to spend more time on fundraising, but to use the Funding Flywheel to work smarter to ensure access to capital without derailing focus from developing the company.

If you want to save even more time, boost investor engagement, and increase your chances of raising what you need you might want to take a look at our self-service funding platform. It is currently being used by more than 200 startups to succeed with more than 10.000 investors through Attract, Raise, and Delight! So start a free trial or book a meeting with a product expert here.

Featured resource

The fundraising playbook

We know that navigating the complex and high-stakes game of fundraising can be a challenge. That is why we have gathered some tips and tricks to make the journey easier.

In this playbook, comprised of checklists, templates, and examples, we have outlined some of the key elements when you are preparing your company for fundraising.